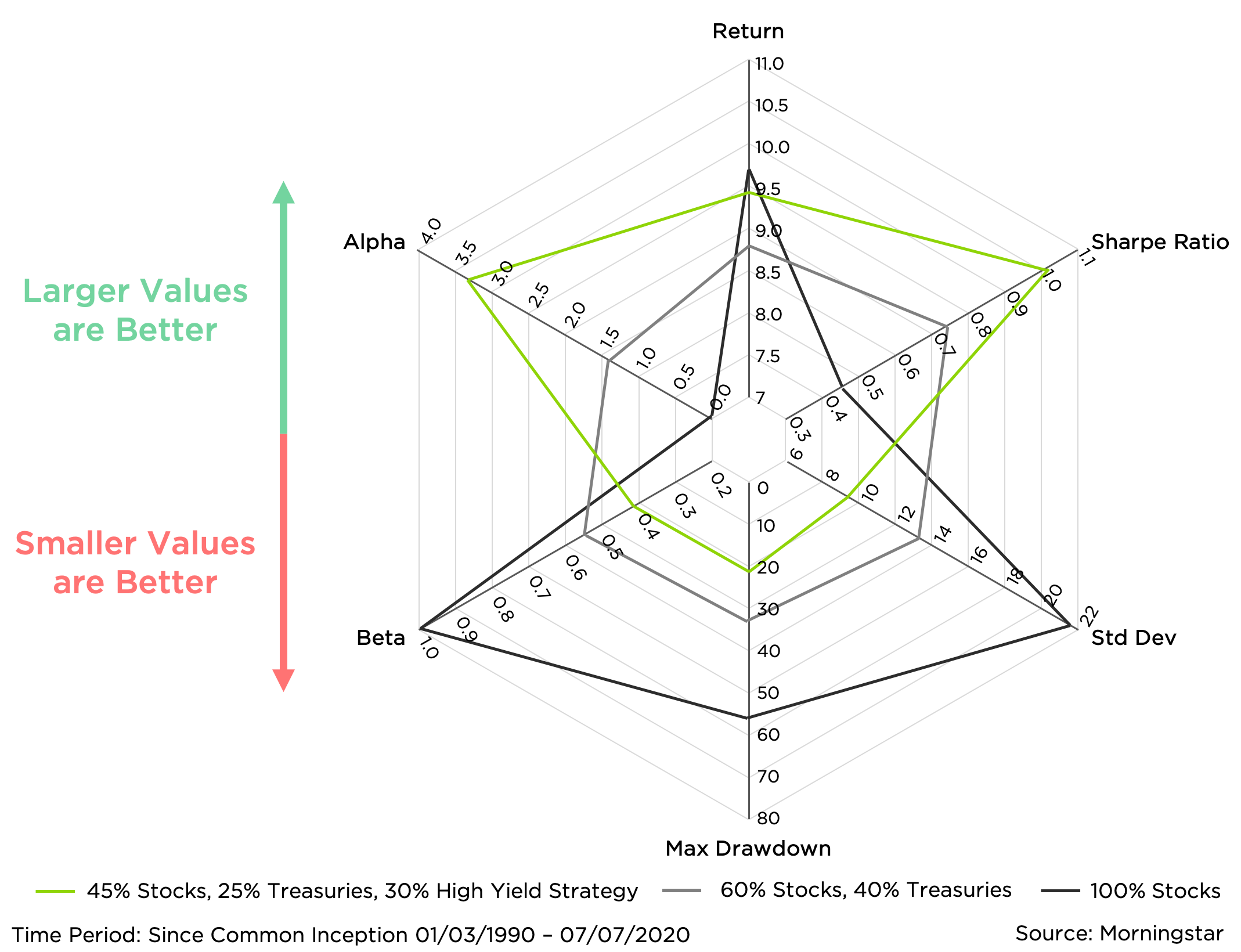

When considering an investment for inclusion in a portfolio, it can be helpful to look at a few summary statistics.

- Annualized Return gives a historical view of the long-run reward for holding the asset.

- Sharpe Ratio indicates the average return minus the risk-free return divided by the standard deviation of return on an investment for a risk-adjusted return measure.

- Standard Deviation is a measure of risk that shows how much returns might vary for investors.

- Maximum Drawdown shows how much an investment has fallen from a previous peak and indicates its possible negative impact on a portfolio.

- Stock Market Risk or “Beta” shows how much an investment moves in-line with the broad stock market. Investments with weaker relationships to traditional asset classes can buffer against broad market declines.

- Excess Return or “Alpha” shows an investment’s over- or underperformance relative to an index, which in this case is the broad stock market.

With these definitions in mind let’s size up several portfolios. One consists of all stocks, one is a traditional 60% stock, 40% bond portfolio, and the third adds a tactical high yield alternative investment strategy to the 60%-40% portfolio.

Traditional 60-40 vs. 45-25-30 with High Yield Strategy

Stocks and bonds each have pronounced strengths and weaknesses. The addition of bonds to an all-stock portfolio improved the drawdown profile, reduced the portfolio’s relationship with stocks, and lowered standard deviation – potentially all good things. Stocks, meanwhile, had a higher annualized return – but they had the worst drawdown profile and did not diversify away stock market risk.

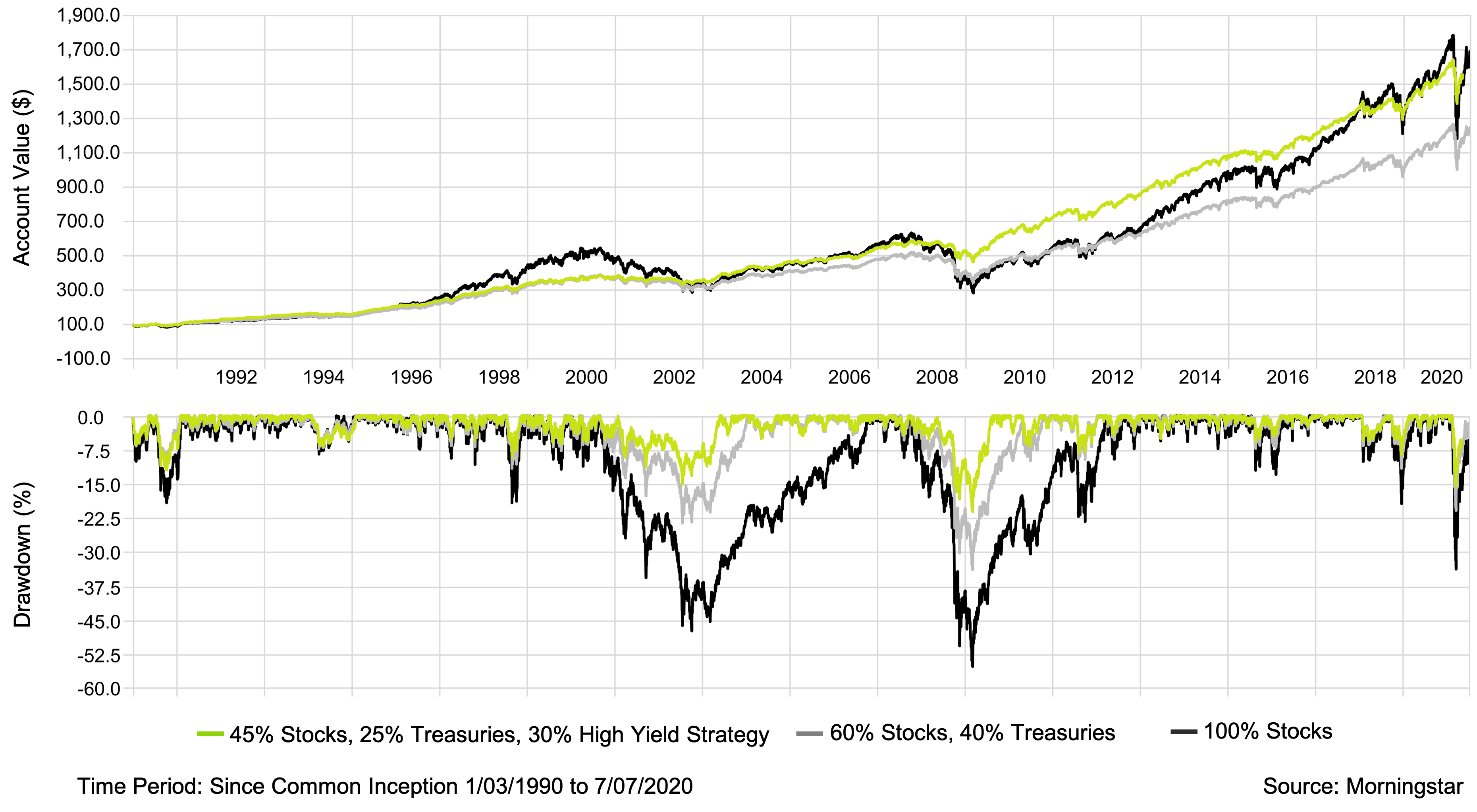

The addition of a tactical high yield strategy, an alternative asset class diversifier, to a portfolio further improved upon the benefits associated with stocks and bonds. Returns were higher than the traditional 60/40 portfolio but lower than the 100% stock portfolio, while standard deviation, max drawdown, stock market beta, and excess return alpha measures showed meaningful improvement. The charts below show how these dynamics play out for investors over time.

Traditional 60-40 vs. 45-25-30 with High Yield Strategy

Because tactical high yield strategies seek to systematically manage risk, they can extend traditional diversification benefits. Blending stocks and bonds together reduced annual returns but created benefits in terms of standard deviation and maximum drawdown. Adding tactical high yield to a portfolio has been shown to further extend the standard deviation and drawdown benefits – without sacrificing returns or taking on additional stock or bond market risk.

Historically, allocating a portion of a portfolio to a tactical high yield diversifier strategy has potential to improve maximum drawdown and standard deviation, with only a small sacrifice of returns and a reduced correlation with the stock and bond markets.