A 60/40 split between buy-and-hold positions in stocks and bonds is a time-honored, set-and-forget, plain-vanilla asset allocation – so much so that it’s often shorthand among advisors and portfolio managers for an unsophisticated “do no harm” approach to managing client funds. Index allocations to these asset classes add diversification benefits, and the straightforward approach can help investors “stay the course” and avoid many behavioral errors that plague other strategies.

But conventional is not the same thing as safe. The most important moments in most allocators’ careers are during times of portfolio stress, when the client is experiencing sharp drawdowns. At those moments, clients are tempted to sell out of equities at the worst possible moments, with drastic consequences for portfolios.

With this in mind, it’s worth noting that even a 60/40 equity/fixed income portfolio can periodically experience intrayear drawdowns of 25% or more, as occurred during the 2008 financial crisis. A 25% drawdown is a challenge for even risk-tolerant investors, so the supposedly “safe” 60/40 allocation does pose behavioral risks to client portfolios.

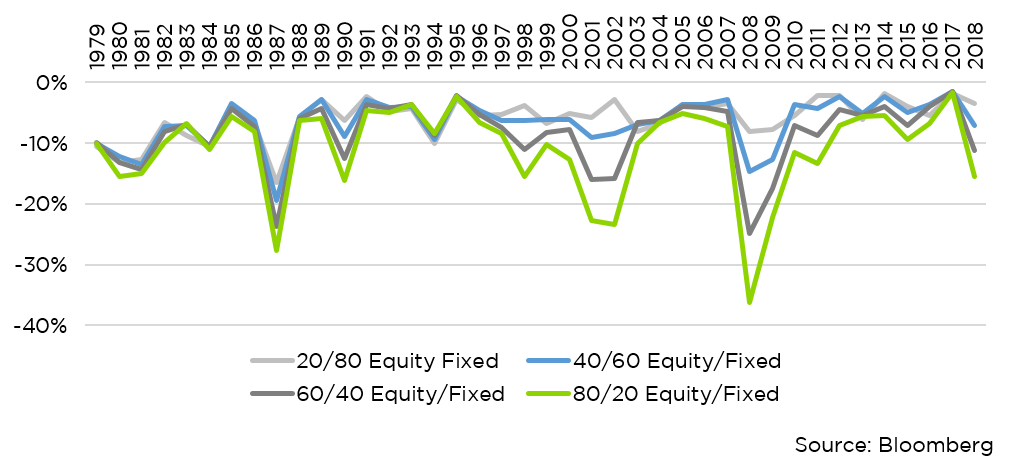

The chart below shows the maximum intrayear drawdown for buy-and-hold stock and bond portfolios from 1979 to 2018. (Important note: Intrayear drawdowns are shallower than total peak-to-trough drawdowns, because intrayear drawdowns start at 0% every January 1st, even if the strategy is in the middle of an existing drawdown.) We constructed the portfolios using the Russell 1000 Total Return Index to represent equities and the 10 year US Treasury total return to represent fixed income. The results will not surprise you: Drawdowns tend to be deeper the heavier the weighting to stocks. More stocks, more risk.

Intrayear Max Drawdowns by Portfolio Type

Despite its purported safety, the 60/40 allocation produced meaningful intrayear drawdowns: 24% in the 1987 crash, 16% in the 2000 Dot-Com Crash, and 25% in the 2008 financial crisis. (Recall again that peak-to-trough drawdowns can be larger than intrayear drawdowns).

Drawdowns recur regularly. They aren’t the exception. The question for advisors is whether clients are genuinely ready to experience such drawdowns – especially considering that many investors tend to think of their portfolios in segments, focusing intently on the equity side.

Amid strong bull runs like the one we’re currently experiencing, clients and advisors may be tempted to over-allocate to stocks. If stocks have not fallen in recent memory, it’s easy for advisors and clients alike to underestimate the behavioral risk of excessive equity allocation.

Given client pressure to over-allocate to stocks while the good times roll, advisors are in a tough spot. There is one straightforward solution: Increasing fixed income exposure while lowering equity exposure reduces the expectation of loss in bad times. Unfortunately that approach often leaves clients wanting more return and rejecting the suggestion.

While there are many ways of tackling this problem, we’d like to float a counterintuitive approach: Allocate a portion of the upsized bond portfolio to a tactical strategy that uses high yield bonds as the “risk on” asset, while reducing equity exposure. In other words, allocate away from stocks, and instead pursue a tactical approach in high yield credit. (Please note that high yield bonds entail greater risk of loss of principal.)

This strategy seeks to reduce total portfolio beta, or stock market risk. When high yield returns are trending upward, this tactical approach benefits from increased credit risk. Because credit spreads are highly correlated with equity returns, clients using this approach will realize some of the benefits of equity allocation. On the other hand, when high yield returns are trending negative, this part of the portfolio shifts to shorter-term treasuries, attempting to gain exposure to one of the safer parts of the fixed income market.

We’ve discussed in the past the risk-reward advantages of high yield credit. High yield’s returns have outpaced those of investment grade credit over the long run. Additionally, the smoother volatility profile in high yield lends itself to trend-following strategies. Lower volatility means fewer false signals, making high yield credit an attractive asset class for trend-following.

While it may seem counterintuitive to reduce a portfolio’s risk by increasing an allocation to a strategy that utilizes “junk” bonds, the historical record indicates that a tactical allocation to high yield may offer satisfactory investment returns for clients while mitigating against the sharp drawdowns inherent to a buy-and-hold investment in stocks.

Amid long-tenured bull markets, it’s especially important that advisors and their clients take seriously the prospect of portfolio drawdowns, and consider whether their equity allocations match their risk tolerances. Adding a tactical component to traditional portfolios is one way to guard against behavioral problems when the good times do come to an end.