Diversifier strategies seek to strengthen portfolios by functioning as a separate asset class, distinct from stocks and bonds. They target investment returns that are traditionally less affected by market movements, attempting to support portfolios in times of stress. Investors should consider judging diversifiers by the level of risk management they provide when traditional strategies aren’t working.

Most people are familiar with traditional stock and bond diversification: Holding both stocks and bonds is historically a proven way to shield against volatility. For example, in the first half of 2020, a 60-40 portfolio has nearly returned to par after the COVID-19 bear market, while the S&P 500 is still down year to date. This ability to bounce back can be the mark of strong diversification.

After this year’s swoon, many investors are re-learning what diversification means. Not everything in a portfolio should be rising all the time; a diversified portfolio often contains assets that are not always moving with the broad market.

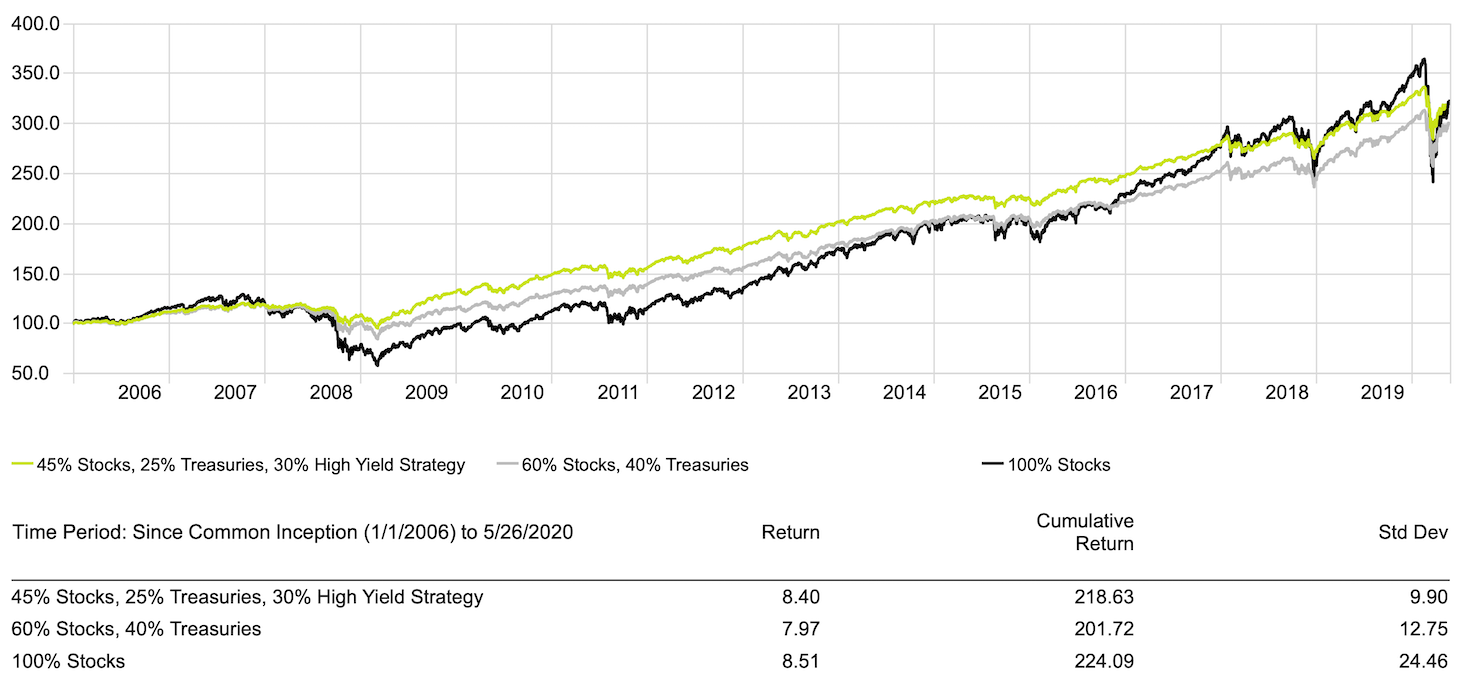

Diversifier strategies tend to take risk management a step further, extending beyond traditional stock and bond allocations to further boost risk management. Below we show that adding a tactical fixed income trend following diversifier strategy to a 60-40 portfolio extended the benefits of diversifying from all stocks to stocks and bonds.

Traditional 60-40 vs. 45-25-30 with High Yield Strategy – Performance

The above 45%/25%/30% Stocks/Bonds/Diversifier blend illustrates the potential risk-smoothing benefits one can potentially experience by taking away 15% from both the stock and bond part of the portfolio and allocating it to a diversifier.

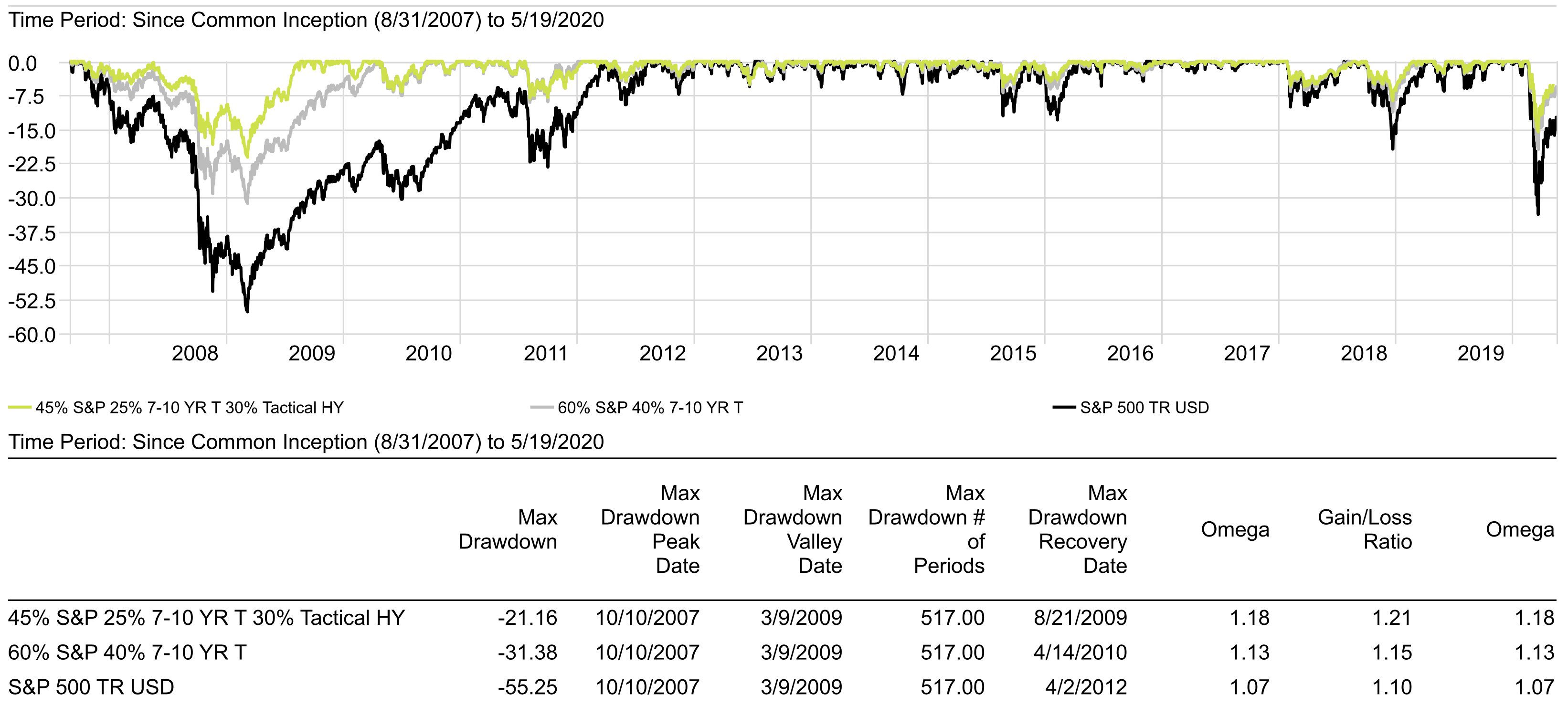

Just as adding bonds to a portfolio strengthened its risk profile amid downturns, a diversifier strategy made a stock and bond portfolio even more robust. History shows a diversifier strategy can improve portfolio drawdown performance without a major sacrifice of long-run performance.

Traditional 60-40 vs. 45-25-30 with High Yield Strategy – Drawdown

Yet the benefit remains: A diversifier strategy aimed at reducing drawdowns can help amid market stress, when investors may need to access portfolio assets or when advisors are hunting for bargains. Because of their unique role, diversifiers do not always perform in lock step with traditional asset classes. No strategy works all the time, and prudent risk management often means not every investment should be providing strong returns simultaneously.

Systematic diversifier strategies attempt to support portfolios in volatile markets. Although many diversifiers may lag amid strongly trending bull markets, the right strategy seeks to lower volatility of returns, reduce capital drawdowns, and enable managers to invest opportunistically when markets are stressed. Diversifier strategies often help advisors prepare for adversity. They can also position advisors to be proactive when markets provide fundamental opportunities.